Metaverse, a hot buzzword that has been spoken in conferences, reported in financial news, and discussed in social media. The Metaverse, is a portmanteau that combines the words ‘meta’, and ‘universe’ first invented by Neal Stephenson in novel ‘Snow Crash’ in 1992. It represents a virtual-reality space where users can interact with a computer-generated environment and other users; digital world that provides a shared environment and economy for all, regardless of their locations.

In 2022, there were 704 financing deal in the global metaverse industry with a total volume of RMB 86.867billion (USD 12.774billion). Of these, 125 projects were completed in China (including Hong Kong, Macau, and Taiwan), with a total financing amount of RMB 12.782billion (USD 1.88billion). In addition, 15 provincial and municipal governments in China have issued 29 special funding policies for the Metaverse since 2022. In addition, from the perspective of the subdivided track, the application, the underlying technology, games, social networks, media and communities, and avatars are the most favored by the capital, especially avatars. [1]

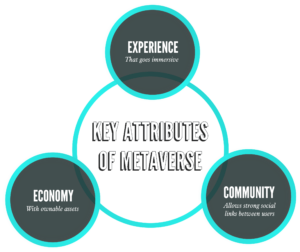

Being a space that is growing fast with creations and innovations that’s happening every day, the definition of Metaverse is also evolving. In this evolution, three elements that metaverse gravitate towards:

Following China’s 14th 5 year plan’s outline of digital economy development with blockchain, VR/AR, AI and cloud computing as key focusing areas that drive economic growth, local governments started rolling out schemes to boost the industry’s development in action. In June, Shanghai government released the city’s 5-year digital development plan and announced its aim to grow a RMB 52 billion Metaverse cluster by 2025.

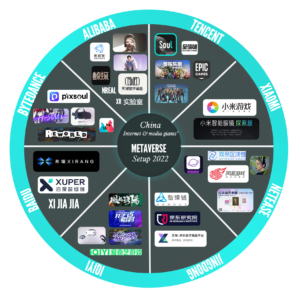

Internet giants BBAT (Baidu, Bytedance, Alibaba & Tencent) and key social media players (i.e., Soul, and Red) have in succession sown their seeds on the Metaverse with different approaches taken and areas of focus. According to Morgan Stanley, the China Metaverse industry market value is expected to reach about RMB 56 trillion (USD $8 trillion), which equates to 49% of China’s 2021 GDP. Metaverse is expected to disrupt the digital world on a par with how internet has dramatically transformed the world. It is a matter of time for the Metaverse to thrive in application, bringing significant impact across industries and weave into our day-to-day life.

China internet and media giants’ setup on Metaverse

Here are the top five insights that brands and marketers should watch out when approaching China’s Metaverse:

1. Me & My Avatars

Me-first economy has been fast growing, with the evolution of culture, values and priorities have shifted towards one-self. “I buy it because it makes me happy” overrides functional benefits. In consumption they look for products with hedonism value, happiness-first products or experiences that help them with build or strengthen their ideal identity.

In Metaverse, consumers are in their virtual avatars, an alternative reality that the environment is created by tech platforms and continuously co-built by everyone who are in that world. New plot of land, new social connections, new identities and looks. How they look does not matter as they can wear a new avatar that is molded in a way they like. Virtual avatars are transforming into a form of social currency.

Soul, an AI-driven virtual social platform, pioneers China’s Metaverse in bringing users an evolutionary social experience. People are called ‘Soulers’ in this world. This new way of socializing is popular amongst the new generation, born after 1995, which accounts for over 70% of Soulers population.

Avatars can be rendered, or it can take days for one to perfect their looks. It gives birth to a new profession – the avatar producers, a huge ‘creator economy’ with passionate and creative individuals monetizing their hobbies through content creation. The digitalized growing-up background of the new generation surrounded by family’s love as the only child at home with benefits from economic prosperity has shaped their unique career view, which questions the traditional 9-5 work practice. In career, they seek for alternative livelihood and turn to jobs that link back to their own interests.

“Back to the time when I graduated, due to the pandemic, it wasn’t easy for me to find a job. I am glad that I’ve become an avatar producer, it gives me more career options than the others in my age.” said Xiao Bao, graduated from college in 2021 and now an avatar producer on Soul.

Since 2019, 74 new professions including those emerged under creator economy like e-sports athlete, livestream anchor, video and audio content creator, have been in succession recognized by the Ministry of Human Resources and Social Security. Income one makes from content creation is as good as a traditional job, there are avatar producers who earn about RMB 0.3 million on Soul in about 4 months’ time. China’s creator economy market size is estimated to reach over RMB 670 billion (USD $100 billion) [2]. With the thriving ‘create-to-earn’ model, we will see more fresh graduates joining the creator army, more new professions will emerge meanwhile.

“Creating avatars helps creators to convert hobbies, personal expressions and creativity into profits and gives birth to new professions like that of avatar creator” said Che Bin, vice-president, and product manager of Soul. Soul unveils plan in upgrading virtual identity’s expression experience with advanced avatar features like dress code freedom. The upgrade will also enable marketers to better connect with Soulers via offering of branded virtual outfits.

Like the metaverse world, opportunities with avatars are virtually unlimited. From launching branded virtual outfits, to crafting branded avatar production experience, there are countless ways how brands could connect with consumers through helping them better express their virtual selves.

2. Rise of Meta Leisure

From online shopping to playing video games or watching e-concerts, many of consumers’ leisure activities are nowadays digitalized. Leisure activities are transforming to be ‘Meta-lized’.

Metaverse game Roblox held China’s first Meta music festival back in 2022’s new year eve, celebrating the arrival of the new year. Over 10,000 of Roblox players attended the Meta party, counting down to 2022 in their avatars in the Roblox world concurrently.

Virtual disco dancing has gained increasing traction amongst the new generation. Xiu Gou (Doggie) Night Club, livestreaming room in dance floor setting that allows users dance with doggie avatars on bilibili, has hit a record high amount with over 0.6 million users dancing together concurrently, albeit the interaction experience the club provided was very limited due to platform’s restraint. Soul is also devoted to offer Soulers more diversified leisure experiences, from virtual exhibitions launched in the past, to more activities under planning.

Behind the rise of Meta leisure is the growing ‘lonely economy’ derived from the increasing popularity of solo-living. More turn to products and services that fulfill their desire of companionship, from leisure activities, entertainment, to pets and more. Post-95s and 00s embrace homestay culture, also known as ‘Zhai’, enjoying comfort of staying home entertained by video games and internet. Under China’s zero tolerance policy to COVID-19, countless offline events have been cancelled or restricted. The activity restriction policy has increased consumers’ homestay time, and thus further enhanced Meta leisure’s demand.

Observing consumers’ needs, brands have started approaching Meta leisure. This summer, Adidas Originals and Pepsi respectively threw virtual concerts teaming up with Tencent’s virtual festival TMELAND, offering the young, branded music experience in the virtual world. Marketers’ approach to Meta leisure doesn’t stop there. Some have even pioneered in integrating virtual experience in select offline leisure occasions. China’s leading music festival, Strawberry Music Festival, this year debut in offering virtual experience in their offline events in partnership with Heineken. Festival participants onsite could enjoy extended experience empowered by metaverse.

Meta leisure is expected to change consumers’ leisure habits. We will see a wider range of Meta leisure activities, gaining more traction from consumers. Gaming and activities affected by social distance policy, including disco, KTV, exhibition, concert, and party, will first stand out. On one side, rise of Meta leisure implies new occasions for brands to engage with consumers, both virtually and physically. Marketers should get ahead, watch out for the evolving consumer dynamics, pay attention to the upcoming Meta leisure activity, and identify the potential roles their brands can play.

3. Virtual Idol Fandom

Idol worship and fan culture in China has been intense, from organized fan clubs, to fundraising, daily popularity boosting hassles and beyond. With outbreak of reckless fan scandals in the idol economy in late 2021, government has stepped up and regulated the fandom culture with ‘Qinglang Operation’. Fans’ action has died down as obsessive public support to idols is restricted ever since.

The crackdown gave virtual idols a perfect timing to rise and shine. In late 2021, Alibaba named virtual idol Ayayi as Tmall Super Brand Day’s Digital Manager, Ayayi has since collaborated with a wide list of brands like Burberry, M.A.C., Guerlain, Alienware and P&G. Same year, virtual idol Liu Yexi debuted on Douyin and acquired over 4.5 million fans with her 128 second first video. It appears that part of consumers’ enthusiasm in human idols have pivoted to the virtual ones. Virtual idol’s influence is growing, particularly amongst post 95s and 00s. Per iiMedia Research, virtual idol related economy reached RMB 107 billion in 2021 and is expected to grow at 66.5% year-over-year.

According to iiMedia Research, the core market for virtual idols will reach RMB 6.22billion in 2021 [3], growing by more than 79.8% year on year. It is expected to maintain a high growth rate and reach RMB 20.52billion in 2023.

In addition, the virtual idol industry has expanded to derivative markets such as garage kit, records, comic con, etc. In 2021, the domestic virtual idol derived markets will reach RMB 107.49billion, which is expected to exceed RMB 300billion in 2023. [4]

Some may wonder why consumers choose virtual idols over human idols. Virtual idols are first originated from the two-dimensional space, where the post-95s and 00s grew up being immersed in with ACGN (animation, comic, game, and novel) culture. The new generation is full of imagination and value spiritual satisfaction. In that sense, virtual idols are just the perfect substance to reflect their values and fulfill their spiritual needs. Let’s not forget that virtual idols can be planned and designed to win audiences’ hearts, from appearance to personalities and personal background setting, with every attribute customized to maximize their likability.

| 53.2% like virtual idols due to idols’ look and appearance |

50.5% like virtual idols due to idols’ characters and personal setting |

Source: 2021 China Virtual Idol Industry Development and Netizen Research, iiMedia Research

To brands and marketers, collaborating with virtual idols mean opportunities to reach the idols’ set fanbase but more manageable partnership and less risks from scandals caused by human idols’ personal misconduct. Liu Yexi builds her fame with her cyberpunk styled fantasy short videos. Electric vehicle brand XPeng has recently launched a new car model with futuristic design, P7 sports car’s Dark Knight edition, in Liu Yexi’s short video episodes. Their partnership turned out well, with excitement created by two unexpected but well-matched elements, the next generation of idol and car, being put together in one story. The collaboration hit Douyin by storm, became a hot topic and sparking conversations online. The partnership’s video content has also received over 100 million views.

On one hand, we expect to see more debuts of virtual idols in the market. Not only will there be more collaborations between brands and virtual idols, but more brands will introduce their own virtual ambassadors too. On the other hand, we will see more celebrities presenting in public’s eyes with their virtual avatars. Celebrity Angelababy has launched her virtual self, Angelababy 3.0, at star-studded Dior pre-fall 2021 show, becoming talk of the town. This year, online video, and entertainment platform iQIYI is scheduled to roll out its first Metaverse singing contest, celebrities in the show will be performed in their virtual avatars. The pervasion of virtual idols widens brands’ options in leveraging celebrity power and varies the ways of collaborating with human celebrities.

Combined with mentioned economic characteristics of fans, Initiative Australia tried a content marketing in 2021, which achieved remarkable results: In 2021, we cooperated with LADbible (Australia’s younger generation social content platform) to market the content The Wheel of Time. By doing so, we hope to increase awareness of this play in Australia and New Zealand (awareness of the IP was less than 22% before marketing). Due to the impact of the epidemic, the influence of traditional outdoor advertising is very limited. We introduced a novel online virtual immersion marketing. We created a virtual world, Gather, that mimics the in-game environment. In Gather, we can interact with our peers in real time, set up our own roles in the play, complete tasks and enjoy achievements. At the same time, the Australian and New Zealand actors in the play will also personally participate in large-scale activities in the virtual world. By sharing the feelings of the main fans about the content, fans and fringe users will be attracted, and the awareness of the whole content in Australia and New Zealand will be increased. Compared to traditional live broadcasts and actor Q&A, this type of marketing is focused on the immersion form, so that the target audience has a deep understanding of the play in combination with content and experiences and is more willing to share it in conjunction with personal real-life experiences. Ultimately, we achieved a 25% increase of more than 10 million browsing and viewing users, and the average time spent in the virtual world was more than 37 minutes (roughly the length of a game).

4. Pursuit of New Exclusivity & Limited Editions

China consumers, especially the post 95s, are into exclusive products. They may line up overnight just to buy a pair of limited-edition sneakers or a blind box doll collectible. With full-functioning digital economy propelled by Metaverse, consumers turn their eyes to NFT (non-fungible token) collectibles.

Scarcity, uniqueness and certifying ownership define NFT. NFT outside of China is decentralized, recording on blockchain as a public ledger, can be traded by cryptocurrency and transferred across NFT wallets. Provided cryptocurrency is strictly prohibited in China, NFTs in China need to settle in RMB, and instead record in a private or alliance blockchain managed by a company or group. Thus, with its distinct differences, the Chinese version NFT is called digital collectible instead. More and more brands start including NFTs and digital collectibles in their marketing campaigns.

Earlier this May, Nike’s first virtual sneaker collectibles ‘CryptoKicks’ were sold at skyrocketed price at about RMB 0.9 million (USD$ 134 thousand). In China, activewear brand Li Ning launched its first digital collectible ‘Wizard Shop in ESSENCE’ leveraging fandom power with NBA star Dwyane Wade’s autograph, and was auctioned at sky-high price at over RMB 1.1 million.

Consumers purchase NFTs for a variety of reasons. Speculators buy NFTs for investment, which may create hype. In China, with digital collectible industry’s self-discipline development initiative against speculation rolled out under government’s guidance this July, secondary trading is restricted. Digital collectible barely has any circulation value. Fans purchase digital collectibles influenced by idol, brand or IP power. Collectors buy for appreciation, valuing collectibles’ cultural value. While some pay for the social value in a good-looking piece, some may just follow trend and buy for fear of missing out (FOMO). In China, according to Baidu, over 70% of users who searched about NFT or digital collectible in 2021 are under age of 30, a generation that prioritizes emotional and social value.

Key Chinese internet players have set their footprints in the digital collectible game. Alibaba strives to propel the in-market digital collectible experiences on its eCom platform Taobao, Riding on World Cup fever, Tmall has recently launched a football season collectible campaign. Red has launched ‘R-Space’, in-app platform that enables auction and purchase of digital collectibles, are with virtual outfits that can be try-on on photos. China expects its digital collectible market to grow at a rate of 150% this year, and reach RMB 29.5 billion by 2026[4].

Digital collectibles can fulfill various brand purposes, from social buzz creation, hunger marketing that drives immediacy, to offering of exclusive products for the privileged, and more. It is an opportunity for marketers enhance brand loyalty by providing consumers unique and personalized collectible experience. When brands leverage digital collectibles to engage with consumers, focus should be placed on creation of collection value, curating collectibles that are of sentimental value, social value, with cultural story or symbolic meaning to targeted collectors. And collectibles’ value does not necessarily stop at the virtual world. Brands like Adidas and Gap have bridged brand love derived from virtual assets to the real world by offering owners of their collectibles opportunities to redeem physical duplicates of the collection. For marketers, the key in curating wanted collectibles is understanding what’s of collection value to your audiences, what resonates with them, and by then embed relevant value into the pieces.

Metaverse Soul launched its digital collection ‘Soul-MOBIUS’, a profile picture collection in which Soulers who own the collectibles are entitled to enjoy a range of exclusive privileges in Soul, and to claim a branded gift in real life.

5. Social Dance Beyond E-quaintance & Strangers

In the past, social networking has been categorized as e-quaintance social represented by WeChat, against stranger social networking platforms represented by Momo and Tinder.

In the Metaverse era, social networking shifts to base on users’ interest. Metaverse in nature is a multipurpose sphere that natures variety and social interaction. Taking Fortnite as an example, Fortnite offers users gameplay experiences at its core, but also hosts live music concerts and events like virtual summer parties. Its players can enjoy all these experiences with others in the game. Under such environment, users can network through interests easily, as interests can be expressed beyond chatting, but put into action using virtual avatars.

Soul currently connects Soulers through their selection of interest tags like ‘pragmatist’, ‘artist’ and ‘thinker’. Based on their pick of tags for themselves, Soulers will be sent to different ‘planets’ to meet their soulmates, likeminded people who share common interests in activities or on a topic. There are some interesting planets like ‘Werewolf’ and ‘Karaoke’ planets. In the past couple years, Soul has accumulated a great amount of Soulers with about 40 million MAU achieved this year.

70% of Soulers are post-95s and 00s, a generation that embraces a wide and diversified list of interests and hobbies. The new generation’s interest-first value also reflects in their way of socializing. When they socialize, they look to connect with interesting ones with shared topics. So they turn to engage in Metaverse like Soul, and leave distance from platforms that are hacked by work like WeChat.

Social connection built virtually enables users to be their authentic selves without stress from stereotyping and expectation on their social roles and appearance. Interest-first connections throw off reserve between individuals and narrow the gap between humans regardless of physical distance in real life, users are more likely to meet someone with spiritual resonance. Thus, a cloud marriage trend is set off on Soul. According to Soul’s informal statistics, over 5,000 couples who met on Soul participated in the Metaverse’ collective cloud wedding live event this 520 festival. In the Metaverse, Soulers actively initiated hashtag #Soul Civil Affairs Bureau#, over 0.4 million of Soulers participated in the conversation, sharing their Soul relevant romantic stories that entered marriage. Soul’s many love stories reveals that the new generation simply value inner qualities like emotional and spiritual resonance in their other halves when it comes to relationship.

As the new generation turn away from making snap judgement by one’s look, appearance, social status, or the wealth one holds, brands should look at connecting with them through delivering emotional value, by embedding more meaning to their brands or products, or addressing products’ inner qualities. Meanwhile, as the sphere where interest-first social connections are cultivated, where shared experiences take place, Metaverse will be a high-value occasion for brands and marketers to reach and connect with the tribes, and couples.

Navigating to the future in the Metaverse

Metaverse disrupts consumers’ path-to-purchase journey with virtual experiences that bridge to the real life, and the recreated social occasions. Consumer journey will inevitably become multifaceted, online commerce will go beyond ‘click-and-buy’. Brands should revisit consumers’ evolving path-to-purchase journey, evaluate how Metaverse changes consumers’ needs, sources of influence and media signals across stages in the journey, pivot their communications approach from there. Meanwhile, marketers should explore how they could leverage Metaverse capability like virtual reality to upgrade consumers’ experience.

The Metaverse is expected to grow and evolve rapidly, reshaping Chinese consumers’ lifestyle. For brands and marketers to win in the Metaverse, the key is to understand underlying value the Metaverse brought to consumers, how it shapes consumers’ culture, lifestyle and behavior, and steer forward from there.

As for virtual social networking, Initiative Australia has been applied in 2020 to improve customer’s brand awareness through virtual scenes and achieved significant effects. Swinburn College of Science and Technology is a public college located in Melbourne. We developed virtual content marketing to improve this client’s brand awareness during enrollment season. For college enrollment, “open day” is a very important way for prospective students to visit campus. However, under the epidemic in 2020, this traditional avenue is becoming very difficult. For the situation of staying at home for a long time, we found that the time young people spend playing games increases sharply because they cannot go out. After thoroughly studying their behavior and needs, we found that people play games not only for entertainment, but also to socialize in isolation and develop a sense of belonging. Therefore, we created a virtual game world called “Swintopia.” After entering the virtual game, potential students can communicate with the teachers to understand the course, participate in the school’s interest organization, and recognize other potential students attending the school – all in the form of games. Compared with the traditional outdoor tour, the virtual world solves the limitation of location, and the form of the game increases the interest. At the same time, playmates in the virtual game world become good friends who will attend school together in the real world. We have achieved a 122% increase in early enrollment applications compared to the previous year, and the number of visits to the school’s official website has increased by 62%.

Sources:

[1] Cailian Venture Capital Communication and IT JUZI, the 2022 Global Metauniverse Investment and Financing Report, 2022.12. Exchange rate 6.8 is applied

[2] Leadleo, 2022

[3] iiMedia Research, Analysis of The Development of China’s Virtual Idol Industry in 2022: Virtual Idols Drive the Market, and the Metauniverse Dividend Explodes, 2022.4

[4] Huajing Industry Research Institute, Report on the Market Development Status and Investment Prospect of China’s Virtual Idol Industry from 2022 to 2027, 2022